If you find yourself looking around having property, getting pre-acceptance to have a mortgage will likely be a significant step. It will help you desire your home search since it gives you a very clear concept of what you are almost certainly able to pay for allowing you to discuss with increased confidence and you will bid with additional count on in the deals.

How much time really does the procedure take?

You might be in a position to done the pre-approval app on the easy cash loans in Jansen web. In this instance, you need to receive an effect – if the software is effective or perhaps not – inside several working days. In some instances, consumers located their address on a single big date.

So that the fastest it is possible to recovery go out, you need to guarantee that all the advice offered can be as perfect while the it is possible to. You should pay attention to the requisite documents and make certain that it is every provided. This might include things like:

- evidence of identity,

- present payslips,

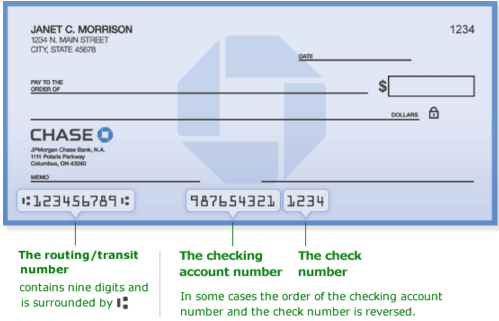

- account comments, and you can

- bank card comments.

As to the reasons find a home loan pre-recognition?

An effective pre-approval may help you understand how much you could obtain and assistance with making plans for your funds. It may also help you in negotiating the right position towards provider and you can real estate professionals as is possible guide you try seriously interested in and then make an offer that following feel subject to finance’.

So what does pre-acceptance suggest?

More lenders have fun with various other terms, however it is an inquiry to ascertain your financial position and you may indicative merely (perhaps not a hope) on bank as to how much you will be ready so you can acquire.

From the Suncorp Bank, we relate to which as the pre-acceptance stage that is susceptible to conditional acceptance after which last recognition.

Does pre-approval mean We have fund acceptance?

Zero. Pre-recognition ‘s the basic stage at your home mortgage techniques and does not mean you have already been formally approved getting a home loan. Having a beneficial conditional approval, your application usually still read next research by the financial because it’s nevertheless susceptible to certain conditions. Discover this type of standards on the pre-approval letter lower than Approval and you will Special Requirements.

Why does Suncorp Financial evaluate good pre-recognition?

We determine a pre-approval mortgage in accordance with the guidance provided by their modern application in addition to credit factual statements about you against a credit scoring Body. We utilize the information i assemble to decide what you can do in order to pay off yet another mortgage centered on your existing items. But despite that look at, your application has been subjected to meeting most other standards.

What will happen immediately following pre-recognition?

After you’ve located property along with your give might have been accepted, you are ready for your home loan become analyzed having conditional recognition. Constantly, another anything need certainly to takes place:

- Package off marketing (totally done in every claims away from NSW & ACT) – We require a copy of your own pick package to suit your the fresh possessions.

- We’re going to need to make sure there aren’t any alter from your brand-new software along with no alter so you’re able to

- the money you owe.

- Valuation of the home – we would need test the house or property you would want to purchase. Access to the property is often create on A home Broker.

- Insurance coverage on possessions – we need to make sure your the latest home is insured before we are able to settle.

You can find whatever else you will need in order to believe or criteria you really need to satisfy, and we also strongly recommend your contact your Suncorp Bank Bank or Agent towards next methods.

Does this pre-acceptance expire?

Sure, that it pre-approval usually end immediately after 90 days about day from matter. Including, whenever we cannot discover property inside months otherwise located support documents on your points changes, a separate app may be needed.

Imagine if all of our latest financing isnt acknowledged?

Pre-approval will not be certain that you can get a home loan. There are many items that may result in your property mortgage app are refused, even though you prior to now acquired a good pre-approval, like:

If you want considerably more details in regards to the software and you will pre-approval processes, feel free to give us an enquiry. You are able to publication an appointment having good Suncorp Lender Cellular Bank, if you’d prefer to go over the procedure really in the an effective some time lay that suits you.

What’s next?

If you were winning for the getting pre-approval for a loan, you’ll have a better thought of whether you really can afford one home you’ve been fantasizing out-of.