Some home improvement programs qualify having grants, that can lower your out-of-wallet will cost you. Given that features won’t need to be paid right back, it may be an invaluable usage of your own time to research the choices.

On the government top, of several agencies provide has getting specific renovations. Such as for example, the Department out of Experts Things brings offers to assist experts having service-connected otherwise aging-related disabilities make residential property far more functional.

Also, check out the You.S. Company out-of Property and Urban Invention to find out if your be considered to own gives predicated on your local area, income, and you can upgrade.

Before moving on the a property improve financing, start with doing a fees estimate. The dimensions of the mortgage you need will have an effect on your choice.

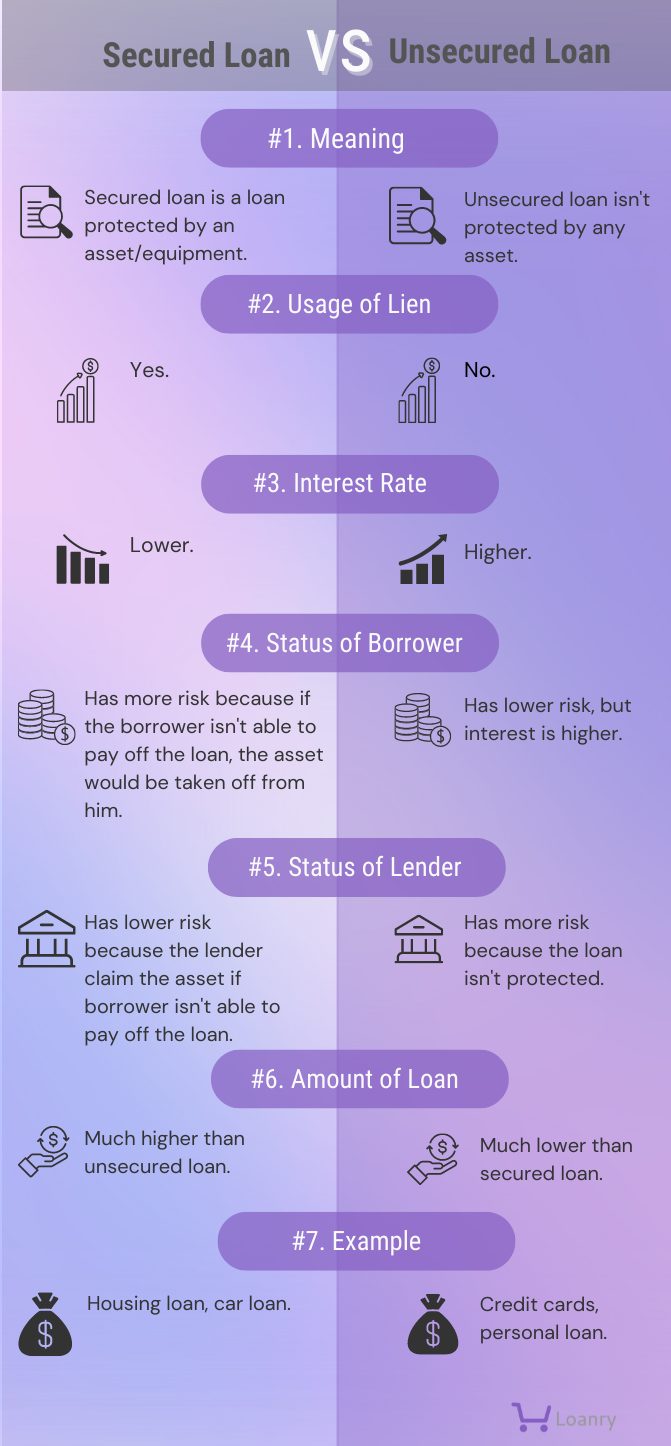

If you would like many bucks, next tapping into your house equity with a guaranteed loan was probably best circulate. But when you only need a few thousand cash, following a consumer loan or home improvement give will be enough to pay for the costs.

Additionally, the timeframe things. Of these which have good credit and you may a pushing you want, you could finish the borrowed funds app to have an unsecured loan easily. Thus, if you prefer the income in your checking account as soon that one can, a similar date otherwise 2nd business day financial support offered by brand new app means of certain signature loans is tempting.

Regardless of the loan choice you select, make sure to have a look at all of your bad credit personal loans North Carolina current mortgage proposes to find the best you are able to bargain to suit your state. In addition to, make sure you’re sure of the latest repayment terminology prior to signing, and have the lender throughout the one late fees otherwise autopay deals that will impact your own overall costs.

Home improvement loan prices

The interest rate you only pay to own a home update loan will are different significantly according to the sorts of mortgage you choose and you will the modern price ecosystem.

With regards to the speed you need protect and you will their creditworthiness, a guaranteed loan – often one minute home loan or cash-out refinance – has a tendency to give all the way down costs than just a keen unsecured personal bank loan otherwise a charge card.

Money to own do it yourself FAQ

If the a house requires developments, just the right financing alternative will vary. Such, when you’re to order an excellent fixer-higher, after that a keen FHA 203k financing is the strategy to use. But if you are a resident having high equity on your own domestic, then property guarantee mortgage or HELOC could be the most useful alternative.

Having fun with a property equity financing otherwise HELOC to help you secure a lesser rate of interest can result in many inside discounts. But when you are not happy to put your family toward range, then imagine a consumer loan or charge card rather.

Your house improvement mortgage you select often change the mortgage label. In general, discover choices one cover anything from a couple in order to 3 decades.

Should you choose a property collateral mortgage or personal bank loan, you can easily create typical monthly payments as well as your mortgage. Should you choose a finances-out refinance or FHA 203k loan, you can easily have only one payment per month that goes your property improve will set you back plus mortgage repayment towards one amortized percentage.

Do it yourself loan cost will vary based on your own borrowing from the bank profile and you will other economic information. Cash-out refinances routinely have a low prices, whenever you are home security funds and HELOCs try somewhat highest. Unsecured credit getting home improvements, such as using personal loans and you can handmade cards, has got the higher cost of all of the. When choosing the right loan, comparison shop to get the low pricing for your condition.

The quantity you can borrow with property upgrade loan may differ according to research by the financing type of as well as your problem. Individuals that have excessively guarantee normally borrow over men and women smaller collateral accumulated within land.